)

Finance teams are an essential pillar in business growth strategy. CFOs have turned into business advisors, whose financial perspective feeds sustainable growth and decision making.

Yet, not all CFOs and finance teams have adapted their processes to meet the demands of this “new normal.”

To focus on strategic responsibilities, finance leaders need to reduce time spent on menial tasks and tedious processes. That means choosing the right software to boost efficiency and productivity.

Top 10 CFO-recommended software for finance

The following tools emerged of an anonymous survey of 170 members of the CFO Connect community.

Finance leaders join from all over the world, with a particular focus in Western Europe, the United Kingdom, and the United States.

Tools were split between six categories. In this post, we've shared just two tools from each, but you can see the full list by downloading the guide:

Cloud accounting platforms

Gone are (or should be) the days of dusty ledgers and filing cabinets full of invoices. Cloud accounting software lives online and is therefore accessible to team members.

Cloud accounting tools are highly practical and easy to use, and also ensure compliance, data security, accuracy, and efficiency. Everything you need, with far less hassle than bookkeepers have put up with for centuries.

1. NetSuite

)

An overwhelming majority of respondents voted for NetSuite as their preferred accounting tool, accompanied by glowing reviews.

NetSuite does it all: the cloud accounting features mean that finance teams can close their books quickly, with a cohesive overview of cash flow and company finances.

It’s the market leader for fast-growing businesses, offering more advanced features than any other small business accounting platform.

Popular features: End-to-end accounting solution; customizable dashboards; real-time visibility.

Best for: Companies of all sizes, used mostly by medium-sized and enterprise companies.

What the experts said:

“Has good connections to other software tools and allows us to automate more.”

“Multi region set-up, consolidation, integration with my tech stack and reference ERP tooling for any new solution on the market.”

2. Xero

Xero is built for smaller businesses with relatively little complexity and standard needs. You can pay bills, claim expenses, handle purchase orders, store files, and connect to your bank.

Plus, Xero offers excellent integration options for companies looking to streamline their tools.

Popular features: Excellent integration options; unlimited users; multi-currency support; ease of use.

Best for: SMBs and companies without much in-house accounting support.

What the experts said:

“Easy to use with a marketplace of integrations.”

“Easy to understand and use.”

ERP platforms

An ERP, or “enterprise resource planning,” is software that integrates core business functions including finance, HR, procurement, supply chain, and other services.

These tools become necessary once a company reaches a certain size and having these functions separated becomes impractical.

[Note: NetSuite was the top ERP system in our survey. Since we've already covered it, we'll highlight a few others.]

3. Microsoft Dynamics 365

Dynamics 365 Business Central is Microsoft’s cloud ERP, ideal for companies already comfortable with the Microsoft suite. The platform integrates your accounting, procurement, and reporting processes, and connects natively with other common Microsoft tools.

Popular features: General ledger; AP automation & purchase orders; custom reporting; data import & export.

Best for: SMBs already using Microsoft products.

What the experts said:

“Simple to use, and can build in process notes and procedures into the system to help users.”

4. SAP ERP (S/4HANA Cloud)

SAP S/4HANA Cloud is aimed more at enterprise-level companies, with global customers including the NBA and PwC. While this can make it more complicated and time-consuming to set up, reviewers noted its robustness and the wide range of tools and processes available.

Once you’re up and running, you’re unlikely to ever grow out of this ERP platform.

Popular features: Payment processing systems; API integrations; customisable workflows.

Best for: Larger companies with increasingly complex needs.

What the experts said:

“Scalable and robust.”

“Established player with a great ecosystem. Platform gets the job done.”

Spend tracking & management

Spend management is a means of tracking, controlling, budgeting, and reporting company expenditures across all of your payment methods and teams.

A dedicated spend management tool integrates with current accounting software and other tools in the finance tool stack, and helps finance teams stay on track and save time.

5. Spendesk

Spendesk’s 7-in-1 solution automates tedious accounting and payment tasks so finance teams and employees can save time while still keeping track of company spend.

The streamlined approval process ensures that employees don’t need to wait days for a purchase to be approved, and managers can work without constantly being interrupted with requests. Built-in controls and 100% visibility protect the company from rogue spend.

Spendesk has both physical and virtual cards to manage subscriptions, handle business travel, and pay for one-off purchases.

Popular features: Virtual & physical cards; invoice payments; subscription management; automated receipt capture; native accounting integrations.

Best for: European SMBs that have outgrown the company credit card and expense reports.

What the experts said:

“It’s intuitive, allows you to manage a lot of credit cards, and lets you give autonomy to managers who make expenses.”

“Integrates with accounting software; automated collection of receipts from employees, along with approval workflows.”

6. Expensify

Expensify lets employees track their expenses on the go. The platform makes it easy to submit receipts, track expenses, pay bills, book travel, and more.

Their corporate card option automates expense tracking and provides cash back and a travel concierge privilege for certain cardholders.

Popular features: Automation; unlimited receipt tracking; cash back on corporate cards.

Best for: Individuals and small companies.

What the experts said:

“Good connection with Quickbooks, offers everything that is needed.”

“Very complete.”

Billing & accounts receivable tools

The invoicing and accounts receivable processes are critical to business success. When cash flows in seamlessly without delay, you can deploy working capital where you need it most.

Just as vitally, you won’t have finance and sales team members chasing unpaid invoices.

7. Stripe

Hugely popular with founders and finance teams, Stripe is the market-leading payment portal for modern companies, B2C in particular. Their API provides flexibility and lets you control how you bill your customers.

Stripe integrates with your current CRM, ERP, or accounting software for a flexible and quick billing solution. It’s considered one of the most versatile and robust billing solutions available.

Popular features: API; flexibility; machine learning technology.

Best for: eCommerce and B2C Companies of all sizes.

What the experts said:

“Great functionality for B2C subscription billing.”

“Stripe is almost flawless. If you can integrate it with your product, it works seamlessly.”

8. Chargebee

)

Chargebee automates the billing and subscription management process for SaaS companies. The platform integrates into any existing tool stack. Along with billing and subscription management,

Chargebee handles invoicing, taxes, accounting, customer management, and more billing-related tasks.

Popular features: Multi-currency and multi-language support; customizable billing cycles; dozens of subscription models.

Best for: SaaS companies.

What the experts said:

“Good price/value and flexibility.”

“Integrations, functionality, UI, reporting features.”

Payroll & HR tools

You need tools that suit the experience and skill sets of both finance and HR professionals. And because every employee is affected by payroll, HR tools need to be particularly end-user friendly.

The following tools help ensure that employees are paid on time, payroll processes adhere to legal requirements, and privacy is respected.

9. Payfit

Payfit is an HR management platform and payroll tool rolled into one. It automates common payroll tasks, eliminating errors and ensuring data accuracy.

Employees can also submit expenses and holiday requests directly on Payfit, as well as view and download payslips.

Over 9,500 companies use Payfit, including Revolut, Railsbank, and Sellsy.

Popular features: Easy user interface; HMRC RTI and pension submissions; real-time payslip updates.

Best for: SMBs

What the experts said:

“Easy to use and created for startups with no HR team.”

“Simple, interconnected, complete, efficient.”

10. BambooHR

BambooHR is an HRIS (human resources information system) that consolidates all payroll, time, benefit, and employee information in one platform.

Clients include Fitbit, FreshBooks, and SquareSpace, alongside more than 26,000 other companies in 100 countries.

Popular features: Onboarding and offboarding processes; E-signatures; mobile app.

Best for: SMBs

What the experts said:

“Many features and integrations. Seems complete.”

“Ability to customise reports, manage data and docs.”

Reporting & intelligence tools

BI software turns data from finance tools, your CRM, marketing tools, and virtually everything else, into user-friendly visual formats like charts and graphs.

Teams are then able to examine and analyse this information and make strategic decisions based on the BI tool’s findings.

11. Microsoft Power BI

Microsoft Power BI was by far the most popular business intelligence tool in our survey. Power BI is one of the most comprehensive and accessible business intelligence tools on the market, turning raw data into visually appealing dashboards and reports.

Because it’s a Microsoft product, it’s part of a suite of tools that finance professionals already use, making integration seamless.

Popular features: Machine learning integrations; scalability; tool integrations.

Best for: Data-driven companies with a range of data sources

What the experts said:

“Easy to grasp and ramp up on it. Excellent for Excel users to scale their skills.”

“Fully integrated in my technological stack, simple and powerful.”

12. Tableau

Tableau, acquired by Salesforce in 2019, is an end-to-end data visualisation tool. Known for its excellent UX, most users don’t need developed technical skills to create compelling charts and derive insights. But those with Python skills and further training can most take advantage of its possibilities.

Popular features: Nested sorting; mobile version; real-time analysis.

Best for: Companies willing to experiment and go beyond the options.

What the experts said:

“Easy to integrate with a cloud data warehouse like Snowflake.”

“Looks nicer than PowerBI and more intuitive for non-geeks, although PowerBI offers great functionalities.”

10 more finance tools to explore

On top of the survey results shared above, here are another 10 tools which CFOs and finance leaders swear by.

The quotes come from our CFO Yeah! podcast, where CFOs share the tools to help you and your finance team to work smarter, not harder.

1. Rudderstack

)

Rudderstack (previously Blendo) is a leading ETL and ELT data integration tool. It helps companies connect their data warehouse with other vital tools. This lets CFOs incorporate sales, marketing, and product data into financial reports, without having to trawl through each individual database.

Recommended by: Pavla Munzarova, CFO at Mews.

"Blendo is a powerful ETL (extract, transform, load) software we use to connect all our tools into one space and extract fresh data without a need to develop our own connections. It’s really user friendly and has a broad range of integrations from CRM systems to ticketing tools.”

Listen to Pavla’s full interview on CFOYeah!

2. Pennylane

Pennylane is a full-stack financial management platform, built to make CFOs’ lives easier. It integrates various softwares and develops a financial OS (Operating System) for European SMEs. This enables finance and accounting teams to collaborate on high-value tasks such as: expense management, piloting cash flow, fiscal declarations, invoicing, etc.

Recommended by: Pauline Sauvage, Business Advisor at Novisto, ex-CFO at Back Market

“It’s a platform that plugs in a lot of tools and can help with everyday finance tasks and problems. I like it a lot more than the ERPs I’ve used in the past. I want to stay away from ERPs - this is different.”

Listen to Pauline’s full interview on CFOYeah!

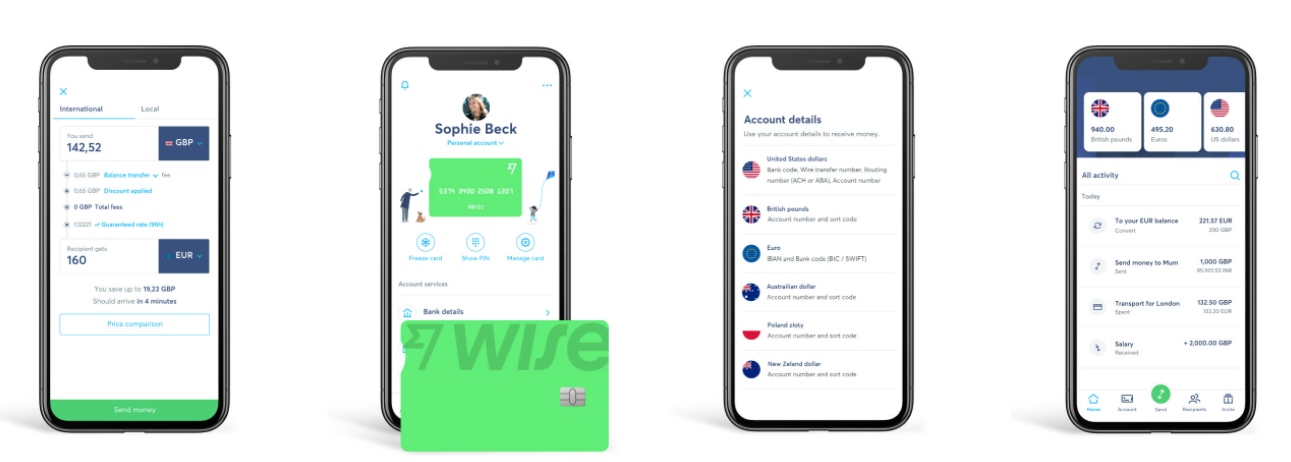

3. Wise

Wise (previously Transferwise) makes international money transfers cheap, easy, and seamless for CFOs and finance professionals. Features include sending or requesting money abroad, and creating a multi-currency account without any hassle. Wise offers services up to 19 times cheaper than its competitor PayPal.

Recommended by: Rebecca Coxshall, former Head of People & Finance at MOJU

“Wise lets you consolidate all your banking in one payment. You hit one button and it goes off to all your suppliers. You never have to enter those bank details again. I don’t want my finance executives spending time punching in numbers - it should all be automated.”

Listen to Rebecca’s full interview on CFOYeah!

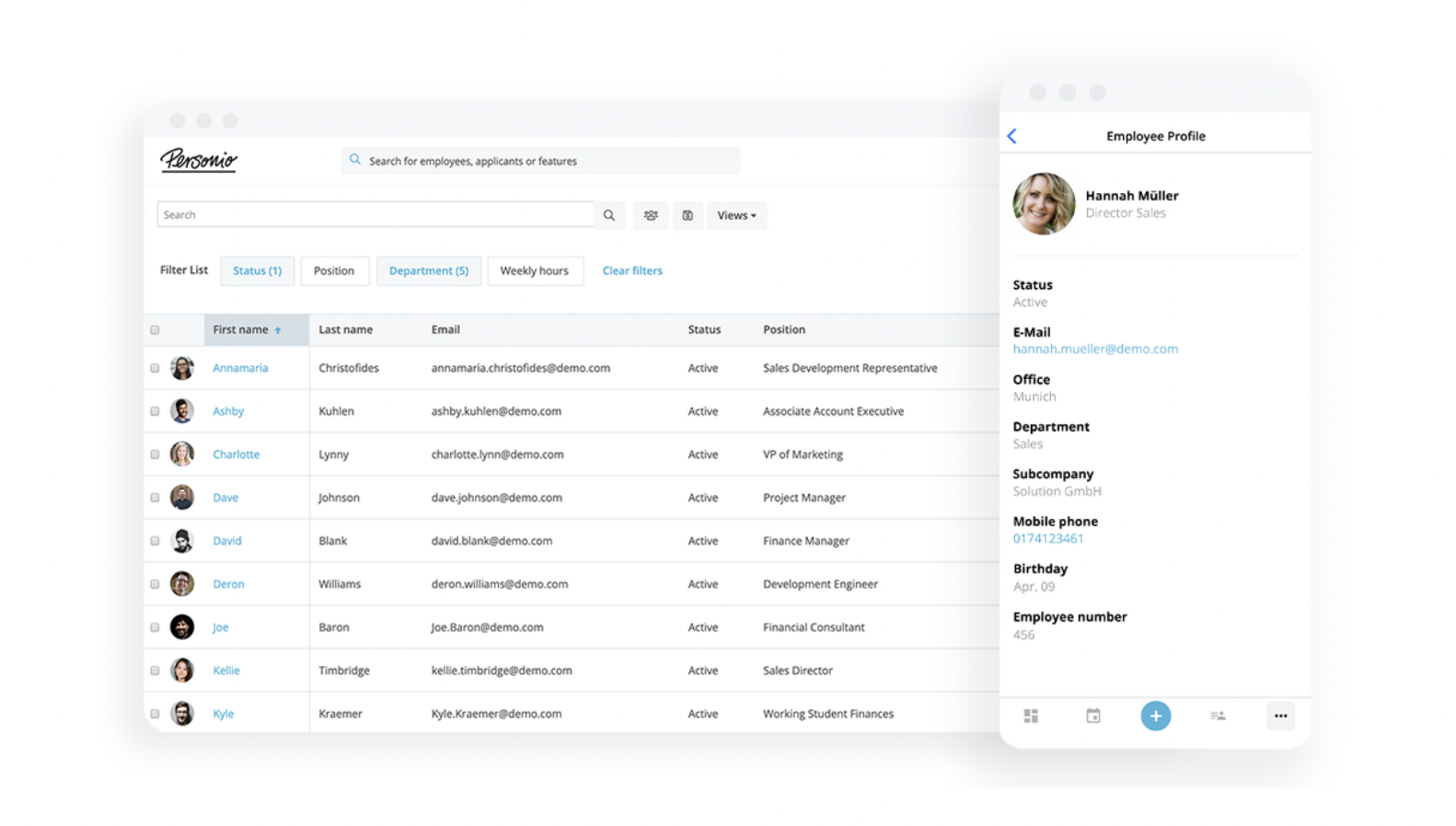

4. Personio

The leading HR software in Europe, Personio offers cloud-based HR management and recruiting software to companies of all sizes. It helps finance leaders automate and optimize people processes, from personnel administration, to payroll and recruiting.

All these features are accessible from one single account, allowing seamless collaboration between finance and other teams.

Recommended by: Sebastian Bourmer, CFO at Statista

“We use Personio for all HR related activities. The Finance function also relies on Personio whenever payroll-related questions arise.”

Read Sebastian’s full interview on CFOConnect

5. Zapier

Zapier helps finance teams automate their processes effortlessly. Its no-code platform allows any CFO to access integrations to more than 4000 online software and tools. Finance experts save time and money automating their workflows–no coding skills needed.

Recommended by: Younès Rharbaoui, former CFO at The Family

“I started using the same tools I’d used before as an entrepreneur, but for finance. So when I want something automated, I can do it myself with Zapier. And that might save me an hour per day. I kept going until I reached a point where there wasn’t much space for automation left.”

Listen to Younès’ full interview on CFOYeah!

6. Google Sheets

A solid competitor for Excel, Google Sheets offers smart spreadsheets that are ideally suited for online collaboration on data analysis. Google Sheets is part of Google Workspace, a suite of productivity and collaboration tools that enables professionals to create, communicate, and collaborate with their teams from anywhere.

Recommended by: Misha Advena, Head of Global Analytics and Strategic Finance at Miro

“I know people have mixed opinions, but when we have so much remote collaboration it’s just an amazing tool. Not only to put numbers together but also to share them and give people an opportunity to react.”

Listen to Misha’s full interview on CFOYeah!

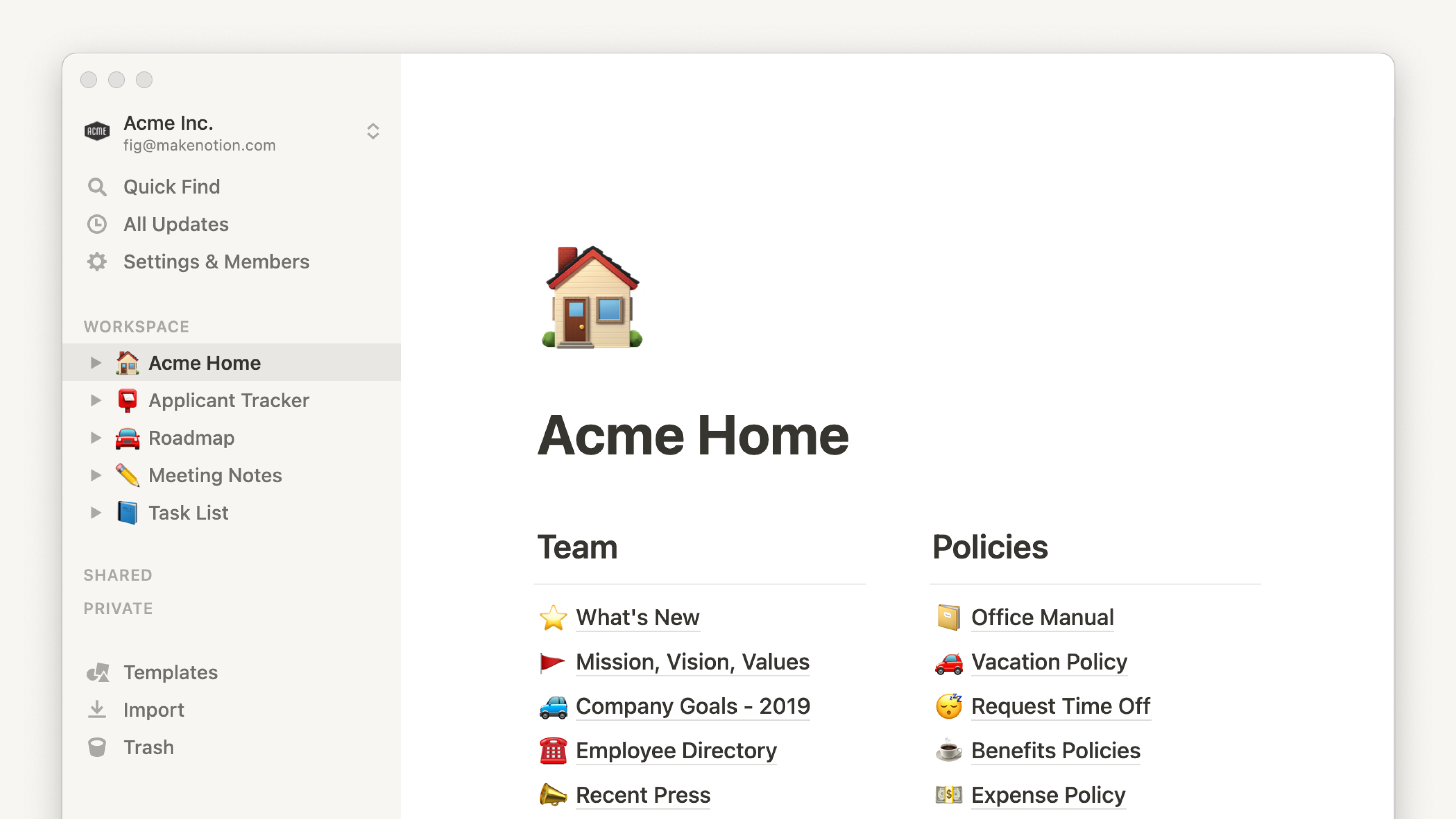

7. Notion

In recent years, Notion has risen as the all-in-one workspace favored by finance, marketing, sales, and product teams around the world. It combines useful features like project management, data tracking, document sharing, and tasks ownership. Notion is fully customizable and a great way to collaborate efficiently, especially for remote teams.

Recommended by: Myoung Kang, Expert in Residence at First Round Capital

“I use it to document processes. If you communicate processes in an organized fashion - with examples and screenshots - they’re more helpful for the other employees. And we also use it to organize our month-end schedules and links.”

Listen to Myoung’s full interview on CFOYeah!

8. Capdesk

A fast-growing equity management platform, Capdesk enables fast-growing companies to keep track of their share schemes and vesting schedules, without losing accuracy. Features include cap table management, issuing options and warrants to attract top talent, smart transactions and stakeholder management–all in a single tool.

Recommended by: Kerry McClelland, former CFO at Fiit

“Capdesk was transformative to my experience of managing the cap table - taking it out of Excel and into a proper format. And the team there were absolutely fantastic. I use it all the time for round modeling and checking structures. It’s been great.”

Listen to Kerry’s full interview on CFOYeah!

9. Asana

Asana empowers remote and distributed finance teams, helping them focus on their goals, projects, and tasks. This CFO-favorite workplace management dashboard is one of the most efficient softwares on the market. Finance teams can easily track and respond to budget or expense inquires across the organization.

Recommended by: Jenny Bloom, former CFO at Zapier

“I know our Controller couldn’t live without Asana. It helps them keep track of everything going on in their team.”

Listen to Jenny’s full interview on CFOYeah!

10. Microsoft Teams

Microsoft Teams is one of the most popular and broadly used tools in the workspace today. It is a hub for team collaboration in Office 365. Microsoft Teams offers many useful features, among which document sharing, online meetings, and many more, to help CFOs and their finance teams be more engaged and effective.

Recommended by: Chad Martin, former CFO at MeridianLink

“It’s not a finance tool per se, but if we weren’t able to stay connected and function well as a team, I don’t think we would’ve been able to achieve what we have over these past couple of years. It’s that ability to quickly hop on a video chat, share screens, and work collaboratively.”

Listen to Martin’s full interview on CFOYeah!

The CFO software stack is always evolving

You'll likely never build the "perfect" suite of tools. As your business grows and changes, and new challenges arise, you'll have to adjust. These 22 tools give you a great starting point.

For more ideas, download the full guide below:

)

)

)

)

)