Typical company accounts

Companies need to keep track of a range of incoming revenues and outgoing expenses, plus a few other important financial statements. Here are 5 key account types for businesses today.

1. Expense accounts

The simplest definition of expense accounts is "a running tally of your business expenses for each period."

2. Income accounts

A record of the company's gross income - the amount of sales made in a given period.

3. Asset accounts

All the assets the company holds, without accounting for any losses or amounts owed.

4. Liability accounts

A record of the outstanding debts your company owes, which can then be balanced against assets.

5. Capital accounts

What the business owner owes or has owed to them. In many businesses, this shows the amount of equity the owners (shareholders) have in the company.

These five account types help to make up your general ledger, the information hub that records every financial transaction your company makes.

3 important financial statements

Businesses also need to track three key statements as part of the financial accounting process.

These relate directly to the business accounts detailed above.

Balance sheet

The balance sheet contains the companies assets, liabilities, and equity. By "balancing" these against one another, you get a sense of how financially healthy the company is. If your business has huge assets and relatively few liabilities (debts), you're likely in good shape. If the reverse is true, you'll need to find ways to reduce your overall debt level.

Once assets and liabilities have been accounted for, equity lets you measure the value of the business to its owners.

Included here may be depreciation expenses - the amount of value lost in an asset as it grows older. Cars, furniture and hardware all have an asset price which changes once they are no longer new.

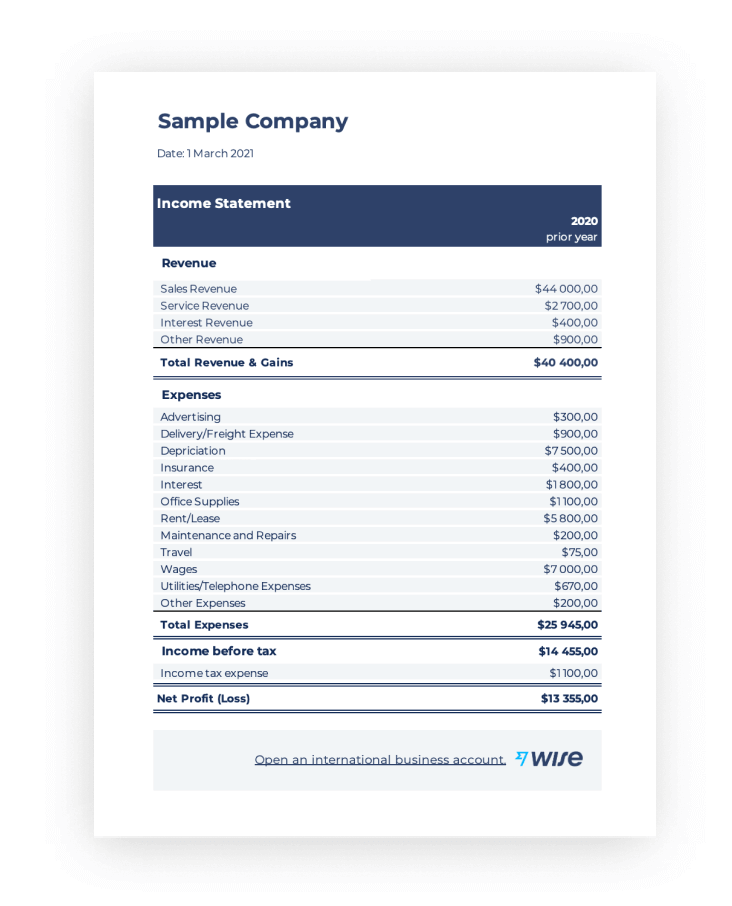

Profit & loss statement (P&L)

The P&L (also called an income statement) sets out revenue versus losses for the period, to show the balance once you've paid suppliers and clients have paid you. This essentially shows your financial position at the end of a month, quarter, or year.

The income statement begins with revenue, broken down by key revenue sources. It can also be broken down by market, if that's particularly relevant to your business.

Next comes expense categories. This is where individual expense accounts become important. You want to show where the majority of spending is going.

The most important line of the P&L statement comes last: Net Income.

Subtract expenses from revenue to see whether the company has made a profit or loss in the specific period.

Cash flow statement

The cash flow statement records the actual cash arriving in and leaving your bank account each period. This is quite similar to the income statement. But income statements track the value lost or gained during a period, whether or not any actual money has moved.

For example, if a client signs a deal with your business, the value of that deal will be reflected in the P&L.

But it will only appear in the cash flow statement once the client has actually paid. For this reason, a company could be cash-rich but still report a loss for the period, if it has significant liabilities outstanding.

Types of expenses

Business expenses are generally divided into 2 main categories:

Essential expenses

A company will have a range of costs that aren't considered optional.

These include:

Taxes

Rent expenses

Utility bills (including Internet costs)

Salaries

Debts (loans and mortgages)

Inventory (especially for retail and other businesses that sell physical goods)

Necessary hardware and software

All of these help to make up the "cost of goods sold" (or "cost of sales"). This figure represents the cost of producing a product for consumers. If you subtract the cost of sales from a product's purchase price, you have its gross margin.

None of these are really optional for most companies. They are essential to making the business function.

Discretionary expenses

Unlike essential expenses, discretionary expenses are technically optional. A company could produce and sell products without these, even if most choose not to.

These include:

Company travel

Marketing and advertising

Investments and innovation

Employee perks

Office and workspace improvements

Internal trainings

These also tend to be more variable between accounting periods. Companies may focus more on innovation or advertising in a given quarter, and then reduce these investments in others.

Operating vs. non-operating expenses

The difference between these two categories is not actually the same as essential vs. discretionary. Operating expenses can include discretionary expenses, provided they're related to core business operations.

For example, marketing and advertising are core operations for most businesses. Without them, the company can't find new customers.

Non-operating expenses may include:

Restructuring costs

Interest expenses payable on loans

Currency exchange fees

Real estate purchases and sales (if this isn't a real estate company)

Even items like expense report reimbursements and office supplies can be considered operating costs, provided they were incurred in the normal course of doing business.

)

)

)