)

Accrual accounting offers a valuable way for companies to measure and show their finance health. Bookkeepers can account for both paid transactions and outstanding liabilities, which is more accurate than simply relying on the cash in your bank account.

But this method also presents a curious challenge for companies managing spending in certain ways. If you don’t have up-to-date credit card and invoicing information - and if employees are behind on expense reports - you don’t know how much spend you’ve committed to.

And for diligent finance teams, that’s a real issue.

In this article, we’ll explain how companies actually can monitor, measure, and account for expenses, even when the payment hasn’t been made.

And the best part is, it’s pretty easy.

What is an accrued expense?

An accrued expense (or accrued liability) is an accounting technique that adds committed expenses to a company’s books before they’ve been paid. Once the expense has been incurred (the company has committed to making a payment), it goes in the books to give a more accurate reflection of the company’s financial position.

This is important in the accounts payable process, particularly when paying by invoice. Companies identify a supplier and agree to pay for goods and services, but typically don’t pay until after the good or service is delivered.

Even though no cash has been transferred, the company is still liable to pay. From a financial perspective, this money is as good as spent, and can’t be allocated elsewhere.

We’ll see why this is so important for proper spend management shortly. But first, let’s refine this distinction.

Cash vs accrual accounting

The common alternative to accrual accounting is known as “cash basis accounting.” Following this method, the company’s cash flow statement reflects what has actually left the bank account.

Take traditional corporate credit cards, for example. If a credit card payment isn’t due until the end of the month, your bank account won’t reflect the true amount spent until this payment has been made.

You could have $10,000 outstanding on the card, but until you make a repayment, the bank account won’t reflect this. Even though this $10,000 is effectively gone - you have to make the repayment.

Generally speaking the total amount of spending committed is the most accurate way to understand a company’s financial position. Whether or not the cash has actually left your accounts is still relevant - you need to pay suppliers - but it’s more of an operational matter.

Which is why spend management best practice focuses on accrued expenditure, rather than cash.

But most companies should indeed have both a cash flow statement and accruals in their purchase ledger and expense accounts. It’s not actually a matter of one versus the other.

Accrual accounting for expenses

Unfortunately for many businesses, accrued expenses are almost impossible to track in real time. If you have shared credit cards, or even individual employees with their own cards, you don’t know what’s been spent until you get the statement at the end of the month.

The same is true for expense reports. Until your teams submit their claims - sometimes months after they were actually incurred - you have no idea what the company is liable to reimburse them.

Invoices are a little easier, because the invoice itself is often handled by the finance team directly. Once they receive it, they can accrue the payment even while waiting to push the payment. But even that assumes that other teams submit invoices on time.

The main problem is a lack of real-time expense data. If you don’t know what’s been committed in real time, you can’t easily keep your purchase journal (or P&L statement) up to date.

Which is why so many businesses struggle to close the books on time each month. New information always keeps trickling in.

Accrued payables in Spendesk

Spendesk’s goal is to give you more control and visibility over company spending. This is relatively easy on a cash basis - unlike corporate cards and expense reports, Spendesk users have always been able to see what’s spent in real time.

But proper spend management also requires visibility over committed spend - including where the payment isn’t complete yet.

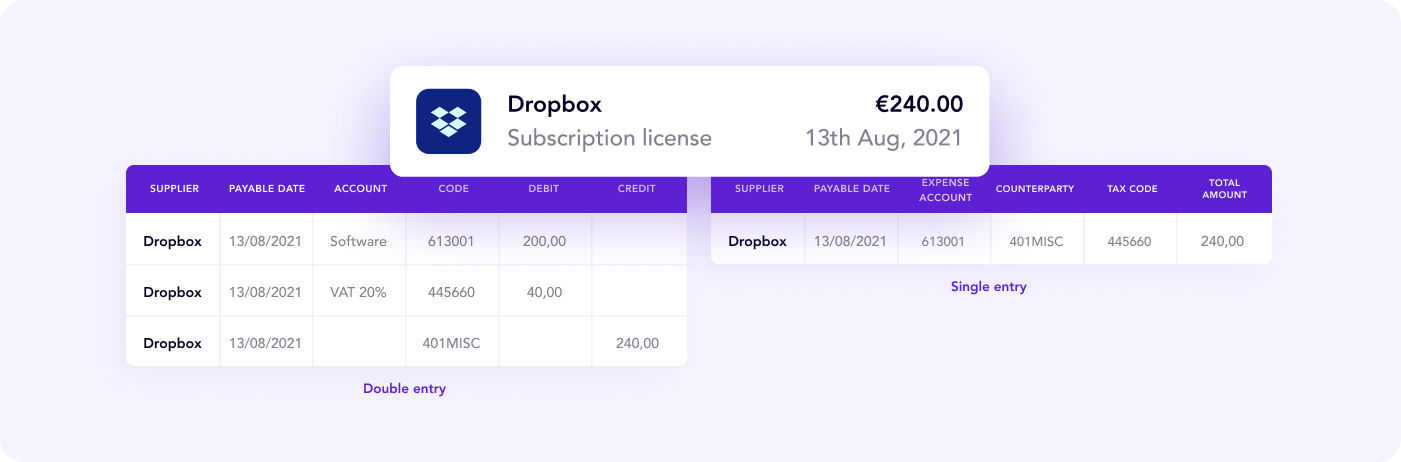

To do this, Spendesk includes two separate journals: the purchase journal and the bank journal.

Bank journal

The bank journal is easiest to understand. This records all payments that have been completed in your Spendesk account. In other words, where the money has left your wallet.

This is essentially your cash flow statement.

Purchase journal

Your Spendesk purchase journal reflects all payments - completed or not - processed through Spendesk. This includes invoices or employee expense claims that have been approved for payment, but where the money has not yet left your wallet.

All payables dashboard

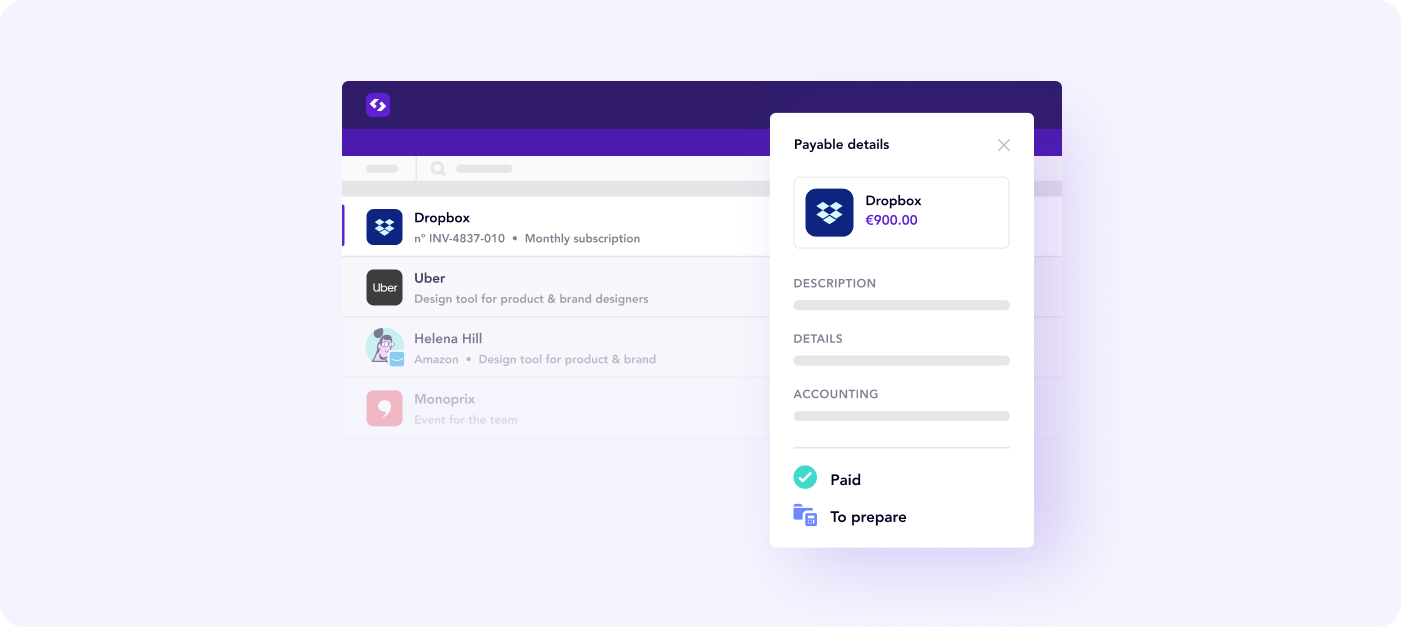

Perhaps the most interesting feature for most users is the All payables dashboard. As the name suggests, this lets you see quickly all payables, their payment status, and whether they’ve been updated in your books.

What’s displayed on this page:

Card payments as soon as they’re settled (usually at point of purchase)

Expense claims and supplier invoices as soon as they’re "validated"

For each payable, you also see:

Their payment status: “To pay”, “To reimburse” (employee expenses), or “Paid”

Their bookkeeping status: “To prepare”, “To export,” or “Exported”

If you’re currently using credit cards, purchase orders, and employee expenses - each with separate systems - this kind of visibility is a goldmine.

Make accounting expenses simple with Spendesk

All the theory in the world is nice, but your ability to manage accrued expenses easily comes down to the right software. Let’s look closely at the precise tools within Spendesk automate account reconciliation and give you more control over spending.

Integrate spend with accounting tools

Spendesk is a spend management solution, not an accounting tool in the classic sense. Instead, it makes accounting far simpler by collecting transaction information and formatting everything perfectly.

No more errors in your accounting tools or ERP.

Spendesk also integrates natively with Xero and DATEV, with more integrations on the way. When you process payments in Spendesk, they’re automatically updated in Xero or DATEV.

The result: You’re literally reconciling payments in real time. Which means no month-end rush to find receipts and check every transaction. It’s all done for you.

Automatically categorize spend

For most suppliers, the correct expense account is obvious. Booking.com or Kayak are always going to be for travel, for example. Name your expense accounts however you like, and Spendesk’s bot Marvin quickly learns which payables and expenses belong to which accounts.

This saves even more time at month end. Payments are automatically assigned to the right expense accounts (based on the supplier), and they draw from the correct budget too (based on the spender).

This works across physical debit cards, virtual cards, and invoice payments. No matter how you pay, you have the same automated workflow.

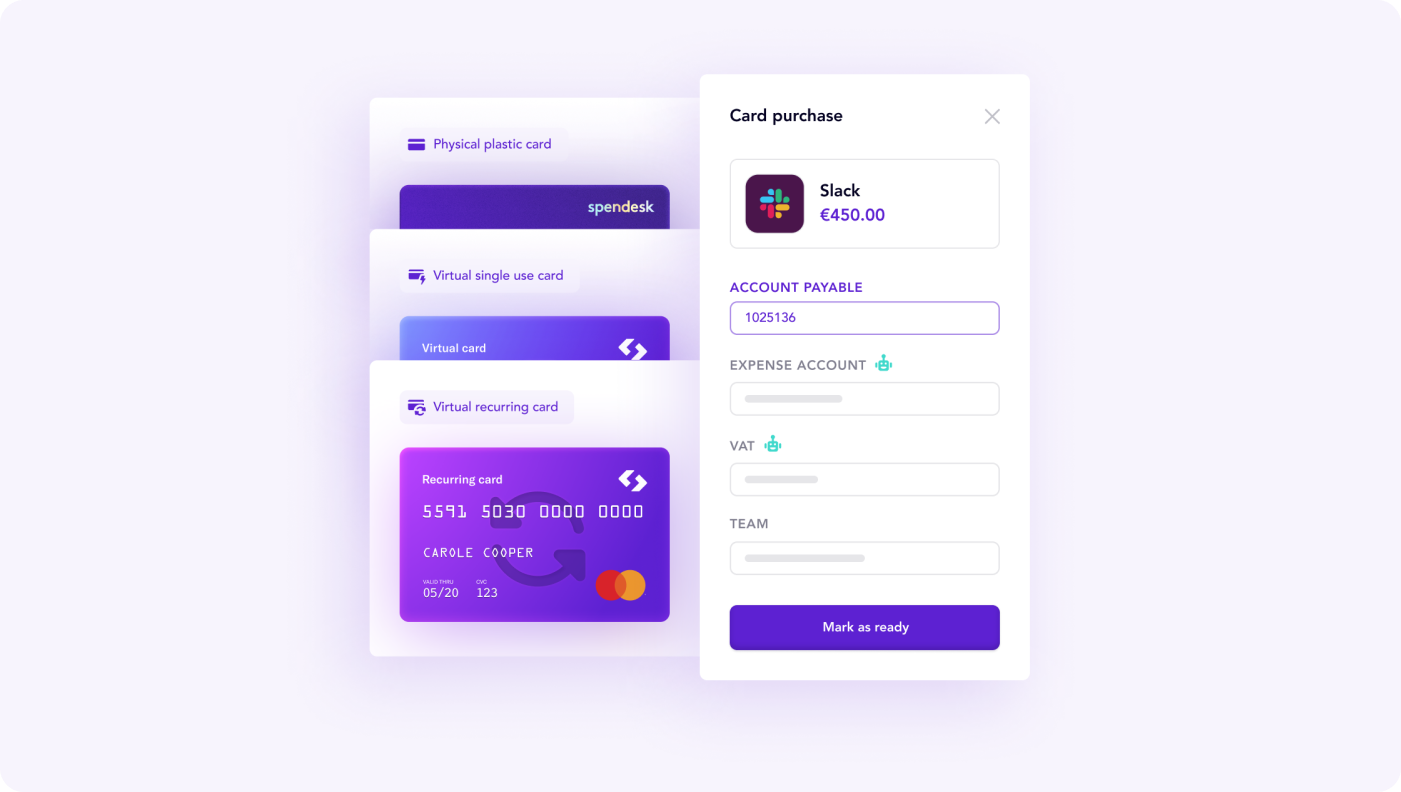

Manage accounts payable for card purchases

You're fully in charge of how granular you wish to be when managing accounts payable for Spendesk card purchases. Create individual accounts payable for each supplier, and assign all payments to the correct expense account and team budget.

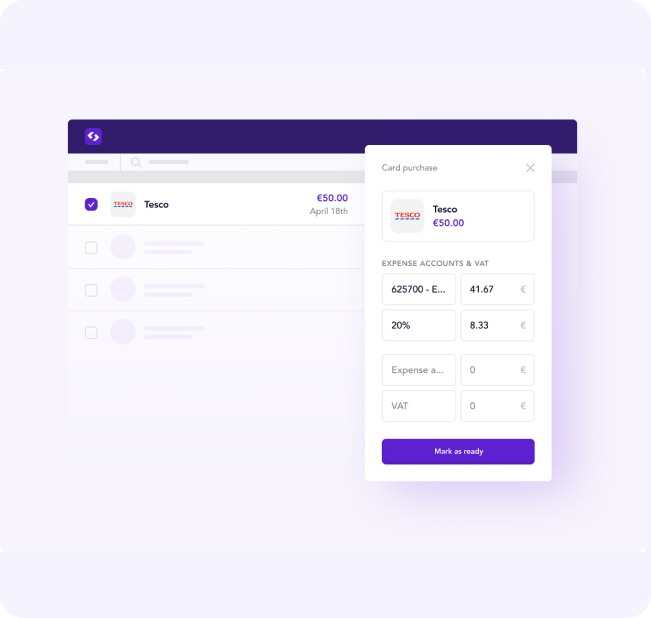

Split payables across expense accounts

Where one payable impacts multiple expense accounts, users can split it between up to three accounts. You can even assign separate VAT (tax) rates to each divided payment, to accurately account for the amount of tax paid.

Track and manage accrued expenses without effort

We’ve looked at some fairly specific, technical accounting concepts. Which are important - good bookkeeping is critical if you want a compliant, audit-ready business. And clean, up-to-date books keep you in control of company cash.

But if there’s one crucial message to take away from this post, it’s that spend management should be integrated. Put card payments, expenses, and accounts payable into one smooth system, and you remove the vast majority of headaches your finance team goes through every month.

Don’t think about the accounts payable process, the expense report process, the credit cards process, and the reconciliation process. These are all part of the same spend process.

So choose a spend management system that brings them all together. It’s the best financial decision you’ll make for your business.

)

)

)

)

)