10 major problems with using the company card to pay online

Published on October 29, 2018

)

There are plenty of things to love about credit cards. Most obviously: paying for things is pretty much always simple, almost anywhere in the world.

Plus, it’s great not to walk around with a briefcase full of cash, terrified of being jumped.

Credit cards have made online payments simple. In fact, the very concept of e-commerce would be practically impossible without these precious pieces of plastic.

But credit cards also have drawbacks. And while they’ve clearly made our personal lives easier, they tend to fall short in the business world.

We’ve written a few times about the obvious problems with the company card. They’re annoying to share, hard to track down, and it’s difficult to track payments. Those are clear issues for in-store and in-person spending.

But what about online payments? And especially recurring subscriptions (SaaS tools and services)?

Surprise, surprise: the company credit card has some major flaws here too.

Already know the problems with online payments? Here’s what you can do about them.

What are SaaS payments?

SaaS stands for “software as a service” (you might use “subscription” in place of “service”). Basically, it’s any software that you can use on demand, hosted outside your own servers.

Any business tool that you can use from your browser is likely going to fit this description. If you didn’t have to install anything first, that’s another good indication.

And most modern businesses use lots of these in their day-to-day. These include:

Sales CRMs: Salesforce, Close, HubSpot Sales

Marketing platforms: Marketo, Sharpspring, Mailchimp

Finance tools: Xero, Quickbooks

Even everyday tools like Gmail and Office 365 are SaaS. And if you use them for business, you’ll probably have to pay.

The point is, we’ve become reliant on SaaS to make our lives easier. So much so that managing them all (and paying for them) is now a big issue.

What about other payments online?

In this article, we’re mostly focused on recurring payments. These are harder to manage because, once you set them up, you then have to remember who made them, why, and when they’re due each month.

One-off payments are a little bit easier to manage if you follow the right procedure. You make sure your finance team knows who made the payment and save a receipt - and you only need to do this at the time the purchase was made.

If you have clear processes in place, this isn’t that tricky.

Recurring payments are a bigger hassle. We’re going to talk a lot about SaaS in this post, but there of course other payments that can be a burden. Things like:

The rent for the company office

The electricity and internet bills

Staff salaries

Food, coffee, and office supplies

Insurance

These aren’t SaaS per se, but they are recurring payments that you need to keep on top of. But note: we’re only talking about credit card payments in this piece. Many of those above use other forms of payment that are more straightforward to monitor - bank transfers, for example.

The reason we care so much about credit cards payments is that these are often made by people all over the company. Your finance team can easily track bank transfers because they’re the ones making them.

It’s much trickier for the finance team to track separate payments made by marketing, sales, and HR, all with the same card.

Enough preamble, let’s look at the big issues with paying online by credit.

1. You can’t easily see how many recurring payments you have

In your personal life it’s not that hard to keep all of your subscriptions in your head. You might have Netflix, Spotify, health insurance, transport (an Oyster card), and the gym. Most of these will be on your credit or debit card.

At work, it’s a whole different ball game. You’ll have subscriptions that cover the whole company - Slack, for example - and then payments that need to come out of individual team budgets.

For fast-growing startups and small businesses, the total number could be in the hundreds.

Here’s a simple exercise: ask every member of your marketing team to guess how many monthly payments the team makes. Just a ballpark figure.

It’s a sure bet that they all give different numbers.

Part two of the exercise? You figure out who’s right. Can you find the answer in 10 minutes? Do you even know where to look?

The thing is, it actually should be pretty easy to know how many payments you’re making. They’re all recurring payments, made on the company card, and tracked by your bank. The data is there.

It’s just designed not to be accessible. And you need a team of money managers to keep it all together.

This lack of transparency and efficiency is going to be a big theme throughout this post.

2. It’s tricky to figure out the total amount you’re spending

If you don’t know how many subscriptions you have, it’s going to be really hard to know how much you spend. Sure, you have the information - it’s there in the credit card bill every month.

But someone (perhaps a whole team) has to go through and “rationalise” every payment - make sure that the right people made them, for the right things. This is just one of many thankless tasks your finance team has to tackle.

And what about your budget projections? Can you confidently say you know exactly which payments are due for each team, every month?

If you’ve got good people on your finance team, you can probably do this. But the time and energy it takes to track all of these subscriptions - let alone project forward - is significant.

3. It’s hard to keep tabs on your overall budget

This is where all the different kinds of payments come back to haunt you. You now need to add those recurring credit card payments up with any one-off expenses. Plus you have those bank transfers we mentioned above.

You can see them all in the credit card bill, but it’s hard to know which are recurring and which are one-off. And when certain payments kick in that you weren’t expecting, it throws the whole budget out of whack.

Figuring out the budget (and sticking to it) is what good finance leaders do. They can probably handle it.

It’s the wasted time that we’re worried about. Every missing receipt or unauthorised payment is another 30 minutes (or more) that your talented team has to spend chasing people. Which is probably not why you hired them.

4. You also need to know who authorised each payment

You probably don’t give your entire company the green light to spend, spend, spend. In fact, for smaller businesses, often only one person has the right to hand out company cash: the founder/CEO.

So what happens when you notice a recurring payment that the CEO doesn’t recognise? It could be totally harmless - perhaps someone just didn’t know the rules. Or maybe the boss did approve it, but that was six months ago and they forgot.

Or maybe it’s just fraud.

When you spend on the company card, there’s no extra step to note down who approved it. Hopefully you have an email chain or spreadsheet for this, but your Salesforce invoices aren’t going to tell you.

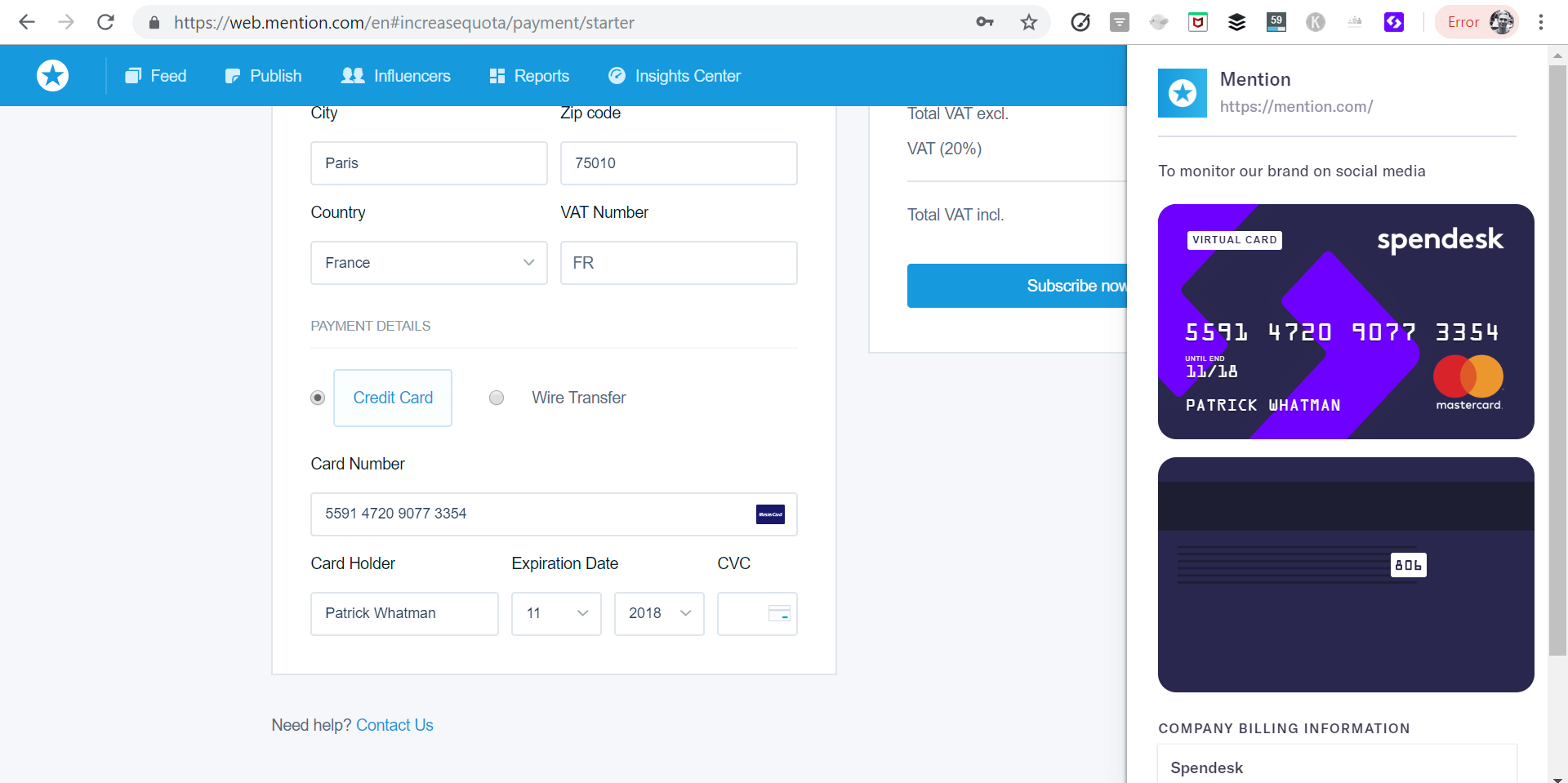

But there should be. And there are tools out there (including Spendesk) that let you make and track all these payments in one step:

More on these at the bottom. We’ve still got more problems to show you.

5. Payment due dates are pretty random

This point comes back to the way you manage your budget and create forecasts. Subscription payments tend to be monthly, quarterly, or yearly. But you don’t set up every payment on the 1st of the month - you start paying as soon as you use the service.

Which is another little problem for budgeting.

Let’s say you want to track your company burn rate (how much cash you spend) weekly. You might have 10 subscription payments going out in week one of the month, a different seven in week 2, 25 in week three, and none in week four.

There’s no rhyme or reason to this - it’s just the way the chips fell.

By contrast, your rent and utilities go out on a fixed date. And your employees all get paid on the last Thursday each month. They don’t change (much).

Every random payment is another row in your spreadsheet. Another complication that you’re paying people to manage.

6. Payments aren’t automatically assigned to specific teams

We talked above about the need to manage different team budgets. But if you’re only using one (or maybe three) company credit cards, it’s hard to keep things separate.

And you need to know which teams make purchases with the card if you want to monitor and assign budgets properly.

Your company card doesn’t care who types in the details on the payment page. It can’t tell the difference. Which means every person in your business has to know the payment process, so that the money comes out of the right team’s budget.

It also means you have to be vigilant if you want teams to have monthly spending limits.

Wouldn’t it be better if your credit card let you “assign” payments to certain teams? So even if you used the same card, it would know which team made a purchase, and would track it separately from the others.

Some cards can. More on this at the end of the post.

7. It’s hard to watch out for fraud

Suppose there are unauthorised purchases on the company card. How quickly will you find out?

We’re not talking about hacks or obvious scams here (although these are a risk with the company card). Credit card fraud includes your team buying things they shouldn’t on the company dime.

Because of the lack of tracking we’ve already talked about, it’s hard to spot dubious payments. All of these SaaS tools you use have silly names - you’d hardly recognise half of them.

So it’s easy to let a few slip through.

Plus, you may not notice until the end of the month (if you’re on top of your finances). And once you notice, how will you figure out who made the payment? Everyone in the building has had access to the card at some point. Some even have the details sticky-noted to their desks.

This system doesn’t work for one simple reason: the company card just isn’t really designed for companies. It just pretends to be.

8. If there is fraud, all of your payments are affected

Once you discover fraudulent behaviour, your best course of action is usually to cancel the card. That’s the case if there are payments you can’t explain, and definitely if your account has been hacked.

But here’s the bad news: all those recurring subscriptions are now going to fail. Someone’s going to have to log into Salesforce, HubSpot, Adobe, LinkedIn Sales Navigator, Google AdWords - and the 40 others you can’t remember - and add the new credit card details.

And for the next month, you’ll discover one more tool each day you forgot you had until the payment failed. And you’ll receive one more email each day from a team member who needs to update a subscription payment.

This is exactly why virtual credit cards were invented. They let you have different card details for each subscription. So if one fails, it’s only one.

We’re going to talk more about them shortly.

9. If you hit your spending limit, all of your payments stall

Most credit cards have some sort of spending limit. Outside of work, these aren’t really a big deal. You know how much you’ve spent today, and you know when your big monthly payments are due.

In companies, this isn’t as clear cut. Your product engineers don’t know that there’s a big, yearly Salesforce payment coming from the other end of the building. If they buy some more server space on the same day, it may just max out the credit card.

And when that happens, all your other payments are stuck until the limit is raised. So if you need to book flights to a conference or buy drinks for the office party, you’re in trouble.

And if you rely on SaaS tools for core business, this is an even bigger problem. Unpaid bills usually mean no service.

So you might not have PayPal on your website (or Square), which means your customers can’t pay. Or you may not have a website altogether if your Wordpress subscription fails.

10. If you need to change credit cards, you have to do it for every payment

You won’t only need to update the credit card due to fraud or it being maxed out. Sometimes, it’s just time for a change.

This could be for a handful of different reasons:

The card was assigned to a specific person, and they’ve left

You have to cancel the card due to fraud (we talked about this above)

You’ve changed cards (for lower fees, better rewards, or you had a better offer)

You’ve changed bank

You old card simply expired

Whatever the reason, you’re then going to have to revisit all those same old subscription payments one by one.

We’ve already explained why this is such a hassle. Just believe us, it is.

A better option than the company credit card

SaaS solutions are now so popular because they solve major issues easily. If you don’t want to build your own search engine, there are tools like Algolia. If you don’t have much accounting expertise, there’s software for that too.

In just the same way, there are now better options for online payments than the company card. And the undisputed champs among these are virtual credit cards.

Virtual cards let your team create a unique payment method for every online expense. You don't have to share the company card around, and its details won't be on hundreds of different sites.

[A simple Chrome extension makes generating cards very simple]

[A simple Chrome extension makes generating cards very simple]

And if you do have to change or cancel your card, it only affects one payment.

If you’re interested (and you definitely should be), here’s a post that explains everything you need to know. But the other main benefits are:

Lower fraud risk: If your account details on Amazon or Spotify get hacked, it’s only this one payment that’s impacted.

Your card only has money for that purchase: When you create the virtual card, you decide how much money to put on it. You can have a monthly budget, or just put the exact amount you need for one payment. And if someone gets ahold of the details, there’s no spare money to spend.

Every payment is tracked: You create unique cards for each purchase. So each spender has to say what it’s for, which team they’re in, and provide any other necessary details.

You can require approval: Tools like Spendesk are designed for teams. When a team member wants to make a payment, their manager is notified and will need to validate it. All of these steps are logged, so you know exactly who authorised every payment.

Virtual cards are even available for private use now. Banks know that people are worried about security, so have made these single-shot methods available.

For businesses, a better option it to use an all-in-one spending platform. This will let you track every card payment, every employee expense, and every subscription you have from the same place.

Credit cards are slowing you down

We looked at 10 problems with making online payments with the credit card. And every one of them leads to the same bigger issue: wasted time.

If you’re a CFO or finance professional, you already know how much time your spend tracking expenses. And how much time you don’t spend planning and protecting your company’s financial future.

If you’re a CEO, ask your finance team how they spend their time. These kinds of tasks are no fun for anyone, and are frankly unnecessary.

New technologies let us automate or completely get rid of the most boring work activities. Managing payments should be one of them.

)

)

)