)

Few company processes are more broken than spending. As we’ve written again and again, both expense reports and company cards were created as a work-around for the fact that employees don’t have access to funds when they need it. Both options are considered classic and reliable - and both are anything but.

And yet, they’re still the norm in businesses worldwide.

The main reason for this is that most companies don’t know any better. These traditional spending solutions are the best we’ve got.

Well, not anymore. And to show you how much better the alternatives can be, here’s a little case study of our teams here at Spendesk. We’ve built easier, more efficient, and frankly better ways to pay at work. For everyone.

Allow us to demonstrate.

3 principles for smart spending

Before looking at the ins and outs of our own spending processes, there are three essential ideas that need to be set out:

Companies need to spend money. Any business that wants to grow and reach new customers will of course need to spend cash to get there. This could be on business travel, new tools like automation, staff (and outsourced help), or advertising. If you want to make real progress, you need to budget for it.

Team members need access to funds. Too many employees don’t have the right or the ability to spend company money when they need it. They either have to ask to borrow a company card, or they’re expected to use their own money for business expenses and wait to be paid back. And both are bad outcomes.

Managers and business owners need control. You should be able to trust staff to act in the best interests of the company. But you can combine this trust with full visibility over what’s spent, by whom, and why.

At Spendesk, we like to think we live these three principles on a daily basis.

So enough preamble, here’s how we use our own tools.

Finance team - full control over spending

Spendesk was built to make employee’s lives’ easier, while giving more control to finance teams. So it’s only natural that we begin with our own finance unit’s experience.

Our CFO Fabien knows that teams need access to funds. He spends months putting together clear budgets with managers, and from there it’s up to the teams to stick to them. He and his team want to keep control over what’s spent, but leave responsibility in the hands of managers and team leaders.

This is a relationship of trust, accountability, and control. For them, control is key.

How this works in real life

Real-time visibility over spending and budgets

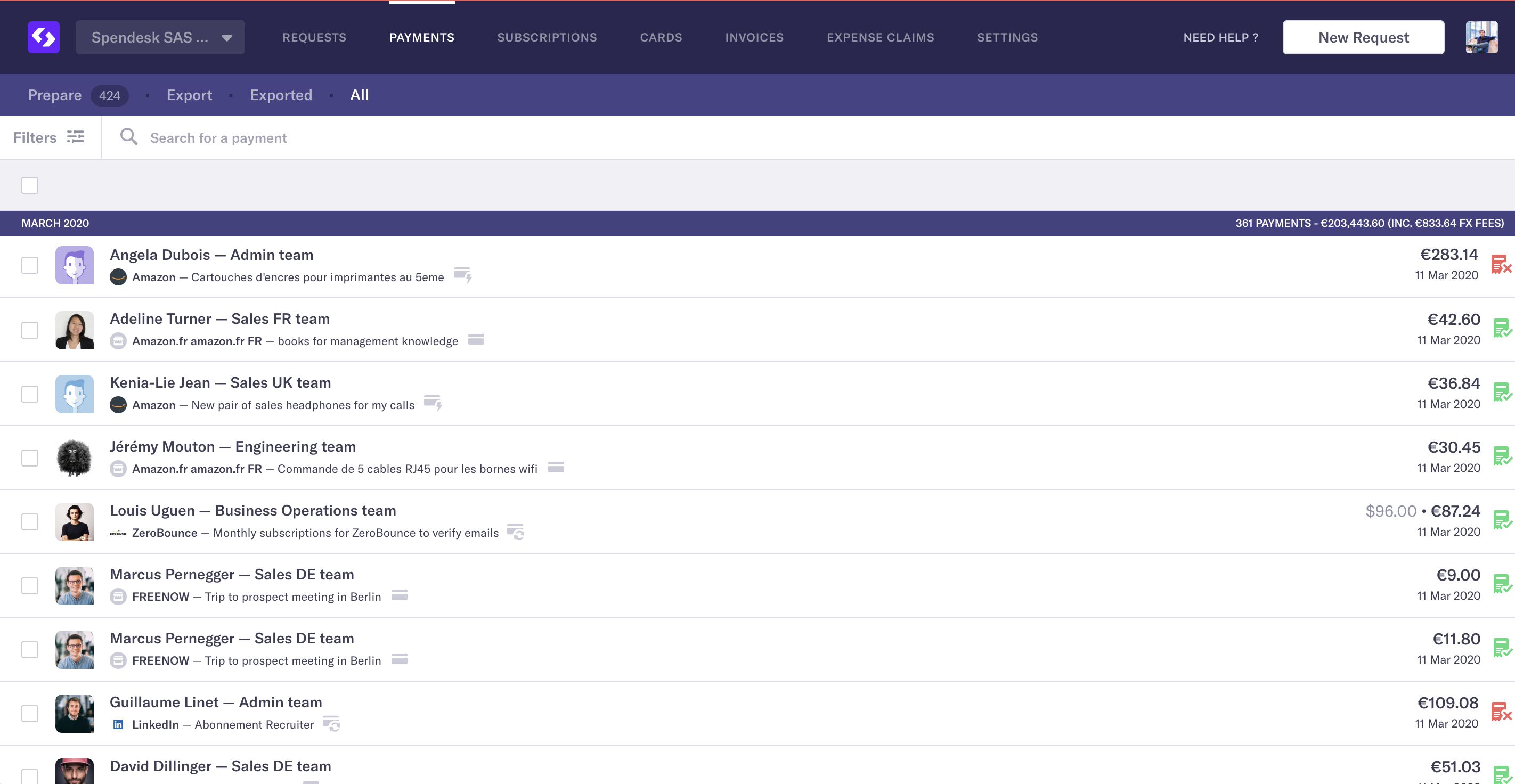

Our finance team always has an eye on the Spendesk platform. Not because it’s time-consuming to manage spending, but because a quick glance today can help them avoid more significant issues in the future.

Plus, Spendesk does a lot of the heavy lifting for them. It shows them payments and invoices to review, pending requests or receipts to upload, and plenty more. So with very little effort, the team can stay on top of our finances in real time.

For Fabien, he only needs one single login to see the whole company's spending. He doesn't have to chase his team for information, and he can trust that the information is up to date.

Finance also checks that the rest of the company is spending correctly. Are team members adding useful descriptions to the purchases, for example? And are the right accounting codes being used?

Finally, they make sure that every payment has a proof of purchase attached. This is dead simple: Spendesk highlights any missing receipts. The finance team sends reminders from the platform in just a click, can also send email notifications, and could even block users from spending anything further until they submit their documents.

And if necessary, they can remind users about their missing documents through Slack (either privately or publicly).

Easily monitor spending approvals

Financial controllers also have the unenviable task of making sure that all company spending is approved and legitimate. In more traditional companies, this can involve a lot of back-and-forth with managers and their teams.

Normally, this would mean asking managers why certain purchases were made. They might also request some sort of proof of approval - an email chain for example.

But Spendesk has built-in approval workflows to keep this information ready for the finance team whenever they need it. As we’ll see below, team members make a request for funds to their manager within the platform.

The request is logged, the approval is logged (along with a rationale), and the finance team can check these any time.

Our controllers can always see who’s spending and why, and don’t have to bother anybody for the information. Spending is controlled by design.

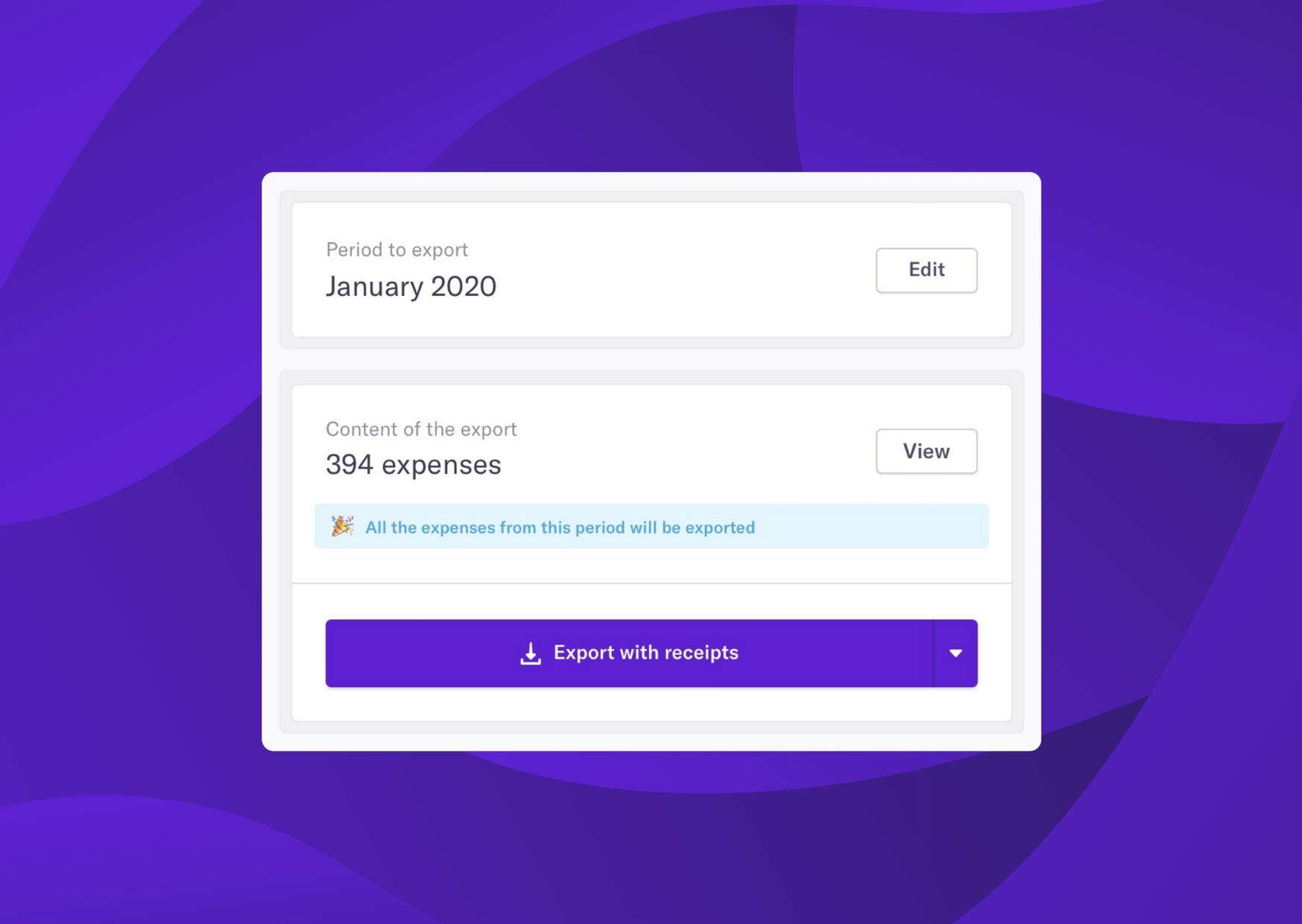

A fast closing process

This is probably the single biggest benefit for our financial controllers and accountants. Every finance team knows the tedious slog that closing the books can be.

But for our finance team, it’s all pretty straightforward. Come closing time, those quick checks really pay off.

Every expense claim or card payment comes to them already formatted, with the appropriate ledger code and proofs of purchase attached. So the closing process only takes a few simple steps:

Visit the Payments dashboard in the Spendesk platform

Ensure that all receipts have been uploaded

Review expense accounts, VAT rates and other relevant information

Approve the transactions before export

Export and upload the data into our accounting tools

And that’s about it!

Overall, Spendesk saves the average finance team around 4 days per month. And once you’ve enjoyed that kind of efficiency, it’s hard to imagine anything else.

Sales and marketing - smooth travel spending

Our sales and marketing teams travel a lot. We’re based in Paris, but we host events in Barcelona, Berlin, London, and San Francisco regularly. We also attend them in Lisbon, Munich, Amsterdam, and plenty of other locations.

Plus, sales love to visit clients in offices all over Europe and the USA.

Thankfully, we don’t have the usual challenges that come with business travel. Every single Spendesk employee has their own company card. This means we can spend money when we need to.

How this works in real life

Let’s take the example of Alfie, our Head of Sales in the United States. In this case, he’s coming to Paris for a sales training with the rest of the teams.

1. Booking travel

The first step is obviously to book his flight. Alfie finds an itinerary that suits him, doesn’t cost too much, and gets him to Paris by Monday morning. Perfect.

One small problem: Alfie can spend a certain amount each month through Spendesk without asking or approval. But flights are over his limit. So he needs a top-up and approval from his manager.

While he’s still on the airline’s website, he opens the Spendesk Chrome extension and makes a request for funds, adding a little description. Nico, Spendesk’s global Head of Sales gets a notification immediately on his phone or by email - whichever he prefers.

Nico can see the description, sees that the price is fair, and approves the purchase immediately. Which means Alfie can pay right away. This whole interaction only takes 10 seconds, and saves the company from sharing credit card details over email. In fact, Alfie uses unique card details for every online transaction, so there’s no risk that the card will be hacked.

The flight is booked, and Alfie just needs to attach a receipt from the airline for our accountants.

2. Getting to the airport

The flights themselves aren’t Alfie’s only travel costs. He still has to get to the airport in San Francisco, and then from the airport to the office in Paris. He’s running a little late, so he grabs an Uber or Lyft to take him to the airport.

Because these services take credit card, Alfie can simply connect his physical Spendesk card to his Uber or Lyft account. He wouldn’t do this with a normal company card, because he wouldn’t have a company card at all. He’d have to pay with his own card and then wait months to be paid back.

Alfie makes it to the airport on time, and the flight goes as planned. When he arrives in Paris, he can use the same Spendesk card either to take another Uber, or catch a local train to the city center and make his way to the office.

3. Meals in Paris

Because this is a work trip, Alfie has a per diem to spend on food each day. The company has allocated a set amount and added this to his Spendesk card for the length of the trip.

Alfie can buy lunch and dinner with his Spendesk card as needed, take photos of receipts and submit them through the app, and never have to worry about filing an expense claim.

And by the way, he hasn’t spent a cent of his own money. Because he shouldn’t have to.

4. Meeting with a client

Because Alfie’s a great salesperson, he’s also lined up a meeting with the Paris branch of one of his American clients. He’s taking a French sales colleague and they’re going to explain to this local entity how its US counterpart uses Spendesk.

The meeting is in a coffee shop. And of course, Alfie needs to shout coffee and pastries for this French client. But it wouldn’t be fair for Alfie to use his per diem money (or his own cash) to handle this.

No worries. Alfie pays with Spendesk in the same way as before. The finance team can see exactly which budget each payment should count against, and their accounting tools are automatically updated to reflect this.

At the end of the week’s training, and after a successful meeting with the French client, Alfie goes back to San Francisco. Every payment he made during his trip - plus any approvals he received from his manager - are recorded correctly and can be easily booked by the finance team.

And his personal bank balance is exactly as he remembers it from before this trip.

Product, Tech, Operations - simple subscription payments

As a modern SaaS business, Spendesk relies on lots of like-minded tech tools and services to move quickly. And if you’re in the same position, you definitely know how hard it is to stay on top of all of these payments.

In the past, you’d set up every payment on the company card. Which means you’d first have to track the card down, then make sure you’re allowed to spend (ask a manager) and manually enter the details into the service’s payment page.

You’d use the same company card on hundreds of websites, have no idea when each recurring payment would be due, and would never know who set up each transaction in the first place.

We don’t have these struggles at Spendesk. We can set up recurring subscription payments easily, from any desktop computer, and have full visibility over all our recurring payments at all times.

How this works in real life

Let’s use our Operations team as an example. They find the tools and set up the workflows that make Spendesk efficient and effective. Which means they have a lot of subscriptions.

1. Initial payment online

Joe, our Sales Operations Manager, has found the perfect tool to automate some boring sales tasks. He’s excited and knows the Sales team will love it. So he goes to the tool’s website, selects the perfect plan, and proceeds to payment.

Before he can actually pay for anything, he needs approval from Romain, the Head of Operations. So he opens Spendesk (either the Chrome extension or the browser app), and makes a new payment request.

Like the example in the video, he simply requests a virtual card, enters the supplier and amount, and gives a reason for his purchase. Romain has all the information he needs, and can approve the payment right away.

2. Future payments

The only difference between the video above and Joe’s case is that this is a recurring virtual card. So every month (or year), it will be charged the amount requested.

Joe doesn’t need approval for each future payment - he already has this. The amount will simply be deducted from this card like it would from a traditional company credit card.

But unlike a traditional company card, these funds can’t be used for anything else.

Payments can be stopped if Joe no longer needs them, but he can’t take the same card details and use them on another site. And if the card details are stolen, they can’t be used anywhere else either.

That makes these online payments more secure than any other option available.

Smart team spending can be simple

So that’s how our own team uses Spendesk in a nutshell. Of course, these examples were just that - examples. Every Spendesker has access to and the right to spend company money when appropriate.

So whether they’re in sales, finance, or operations, or members of our admin, HR, or customer success teams, they can spend easily and securely whenever necessary.

If you’re a fast-growing business that needs scalable spending, or a more mature company hoping to modernize and move off legacy tools, you can benefit from the same processes we use here.

There’s never been a better time to upgrade your outdated finance processes.

We’d love to help.

)

)

)

)

)

)

)